Home health M&A forecast strong for 2023, but valuations could fall, report finds.

Home health will continue to be a magnet for private equity and corporate investment in the upcoming year, according to an investment outlook report released Monday by professional services firm KPMG.

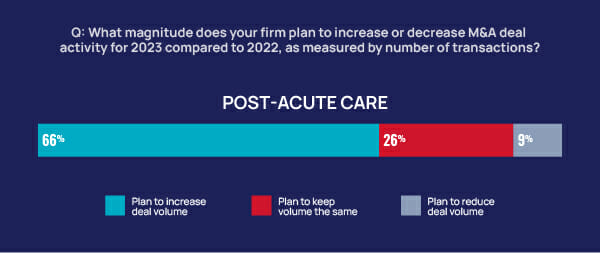

In a survey of 300 investors, 66% said they intended to increase the number of deals in post-acute care, including home health, over the next 12 months. A little more than a quarter of respondents said they planned to conduct the same number of post-acute care deals, while the remaining 9% expected deal volume in the post-acute care segment to decline.

Ash Shehata, KPMG national sector leader for healthcare and life sciences, told McKnight’s Home Care Daily Pulse, home health remains attractive to investors for a couple of reasons: patients increasingly prefer to receive care in their homes and healthcare overall is a safe investment in times of economic uncertainty.

“Going into a recession or going into times of questionable economic uncertainty the industry always likes to go back into healthcare and life sciences,” Shehata said.

Home care and hospice have been hotbeds of mergers and acquisition activity over the past few years. While the sectors saw some mega-deals in 2022, including UnitedHealth Group’s announced acquisition of LHC Group and CVS Health’s purchase of Signify Health, M&A activity cooled compared to the previous year. The sector tallied 177 deals in calendar year 2021 but had only completed 77 deals through the third quarter of 2022, according to M&A advisory firm Mertz Taggart.

Shehata attributed the lower number of deals to rising interest rates and the labor shortage. He expects those headwinds to continue this year, lowering valuations for home care firms. But lower valuations could attract more cash buyers looking for deals, according to Shehata, or open the door to different kinds of deals.

“We’ve seen these carve-outs, joint ventures and other things when [the cost of] capital goes up,” Shehata explained. “I’ve seen many organizations subcontract out sub-acute care.”

Shehata said agencies that can leverage technology, attract workers through flexible scheduling and prove they can reduce hospital admissions will become more attractive partners to health systems, larger home care firms and payers.