The final home health rule could revitalize moribund mergers and acquisition activity in the home health sector in the final months of 2022, according to a new report by M&A advisory firm Mertz Taggart.

“Now that the rule for 2023 is set, we should see an uptick in Q4,” Mertz Taggart Managing Partner Cory Mertz wrote in the company’s third quarter M&A Report.

Uncertainty surrounding the Centers for Medicare & Medicaid Services’ Medicare payment cuts to home health agencies, along with fewer home health, hospice and home care firms coming to market put the brakes on M&A activity all year, according to the report.

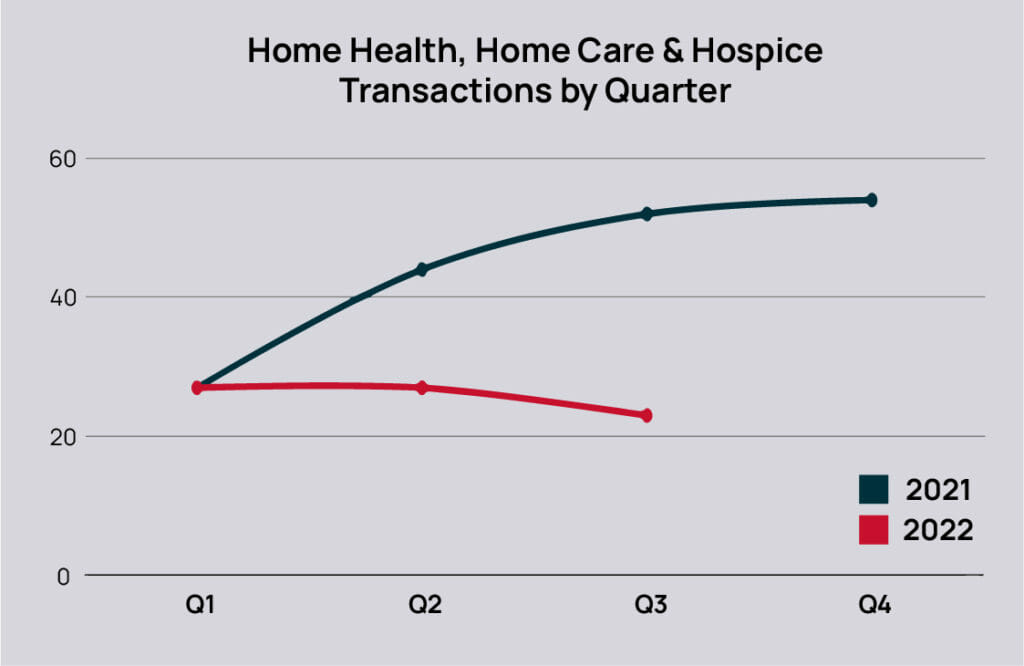

Mertz Taggart reported 23 total deals in this year’s third quarter, less than half of the 52 deals reported during the same period last year. The 77 deals so far this year are 40% fewer than the 123 reported during the first nine months of 2021. Mertz Taggart reported slightly fewer deals than an earlier report by Irving Levin Associates LLC based on a different methodology.

Mertz Taggart tallied only eight home health deals in the previous quarter, nearly one-third of the 21 deals reported during the same period in 2021. Some large home health firms, including Amedisys, paused home health acquisitions over the summer as it awaited CMS’s final decision on the rule. Among the few deals Mertz Taggart noted in the quarter was Richmond, VA-based Care Advantage Incorporated’s acquisition of National Home Healthcare in Northern Virginia for an undisclosed amount. It was Care Advantage’s 16th deal in four years.

Hospice and home care also scored half as many deals in the third quarter compared to the previous year. Mertz noted that home care could continue to be a laggard if inflation continues to make it difficult for consumers to pay out of pocket for personal care services.

“The usual consolidators are seeing demand for private-duty home care services softening across their networks, as individuals paying for these services are feeling the pinch in their financial portfolios, causing them to cut back on their hours,” Mertz wrote. “However, we are seeing this play out differently, depending on the geographic service area, with the more affluent areas less affected.”