Medicare Advantage (MA) is quickly overtaking fee-for-service (FFS) Medicare in terms of the number of enrollees, according to a data science expert. To stay in step, home health agencies should start initiating relationships with MA plans and networks, he said.

“As this shift is occurring and as we’re starting to see Medicare Advantage grow [and] fee-for-service shrink, healthcare organizations especially home health agencies, really need to adapt to what’s going on in the changing market,” said Michael Neuman, vice president of data science and engineering for Trella Health. He spoke during a recent webinar sponsored by the National Association for Home Care & Hospice.

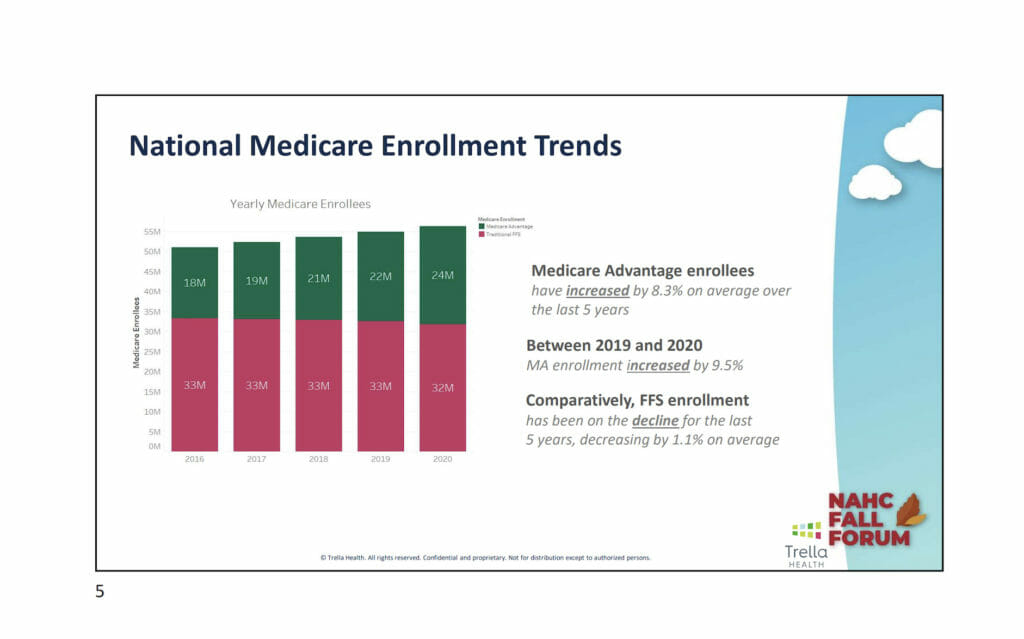

The number of enrollees in MA increased by 8.3% on average over the last five years. Between 2019 and 2020, enrollment rose by 9.5%. Comparatively, FFS enrollment has been on the decline for the last five years, decreasing by 1.1% on average. This year MA is expected to exceed 50% of eligible lives, he said.

Market penetration

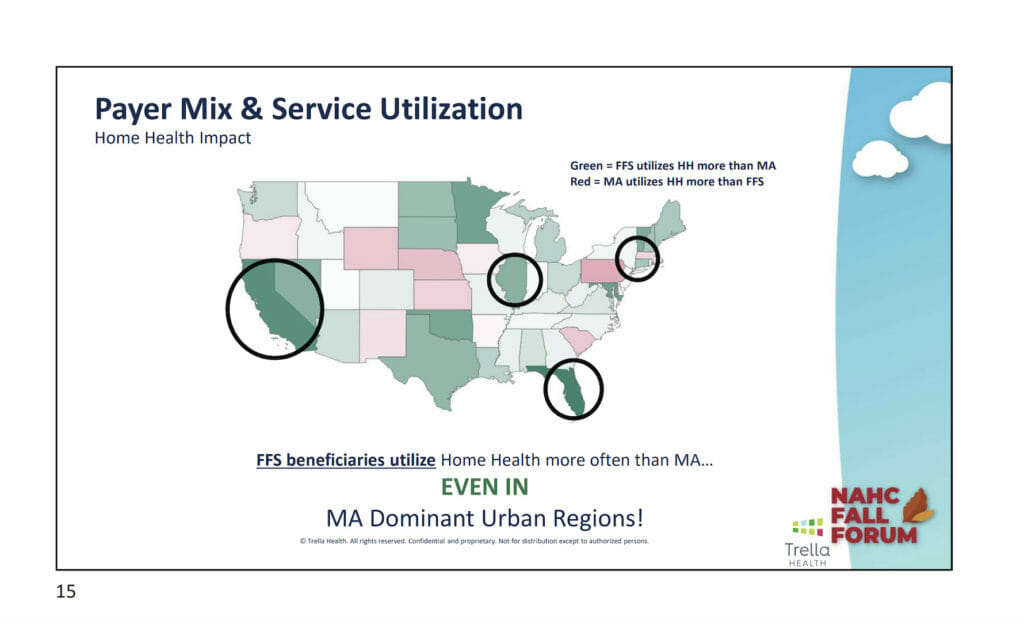

While MA is expected to continue growing over the next decade, the expansion is not evenly distributed across the country, he said. Five states have more than 50% MA enrollment. And MA penetration is higher around the major metropolitan areas. There is a corresponding lack of MA enrollment in rural regions.

But this balance could change. He postulated that when a particular market becomes saturated with an overabundance of plans or people enrolled at a high rate, MA plans will have to start looking to market to more rural areas.

“As the opportunity starts to dwindle for Advantage plans in urban areas, the attention is going to have to switch to other markets to continue growth,” Neuman said.

Important to note is there appears to be a discrepancy in the use of home health by traditional Medicare patients versus MA patients, he said. Throughout the country, FFS beneficiaries use home health more than MA beneficiaries, even in MA-dominant urban regions. Several factors could explain this phenomenon, including possible home health barriers for MA beneficiaries, inadequate MA networks to support home health services and lack of patient education and engagement among MA beneficiaries around home health. The danger with this trend is decreased home health volume from MA plans, he said.

Pay attention to quality

Neuman talked about the “triple aim” concept in healthcare: Cost, outcomes and quality. He emphasized that when deciding to partner with MA plans, home health agencies need to do their homework. Not all MA plans are alike. He offered examples of MA plans serving home health agencies that had low readmission rates but high hospitalization rates after 30 days.

The moral of the story? “Home health agencies really need to pay attention to the payer mix on the basis of both volume and quality,” he said.

In this regard, data can come in handy.

“The winners prove to be the organizations that have the most valuable insights and the most data to back their decisions,” he said.