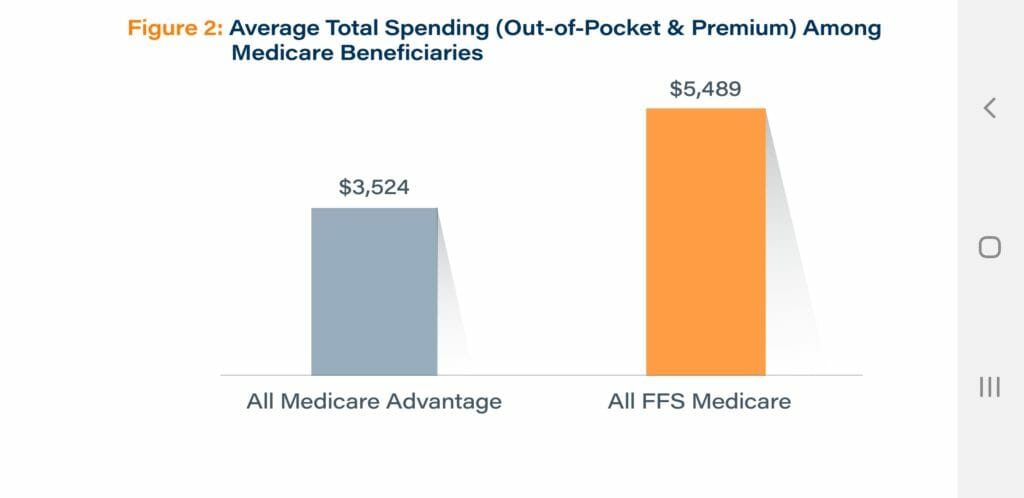

Seniors with Medicare Advantage (MA) plans are paying about $2,000 a year less in premiums and out-of-pocket costs than their counterparts with traditional fee-for-service (FFS) Medicare plans. That’s what research firm ATI Advisory found in a new study for the Better Medicare Alliance.

The latest report is based on 2019 Medicare Current Beneficiary Survey data. It found the $1,965 MA beneficiaries saved in 2019 was $325 more than they saved in a previous survey. Despite the cost difference between MA plans and FFS plans, the report found little difference in the healthcare satisfaction levels among seniors enrolled in both types of plans. Both groups also had similar clinical and functional needs, as well as chronic conditions.

MA plans’ benefits

ATI advisory researchers found MA plans continue to demonstrate important cost protections and value to beneficiaries.

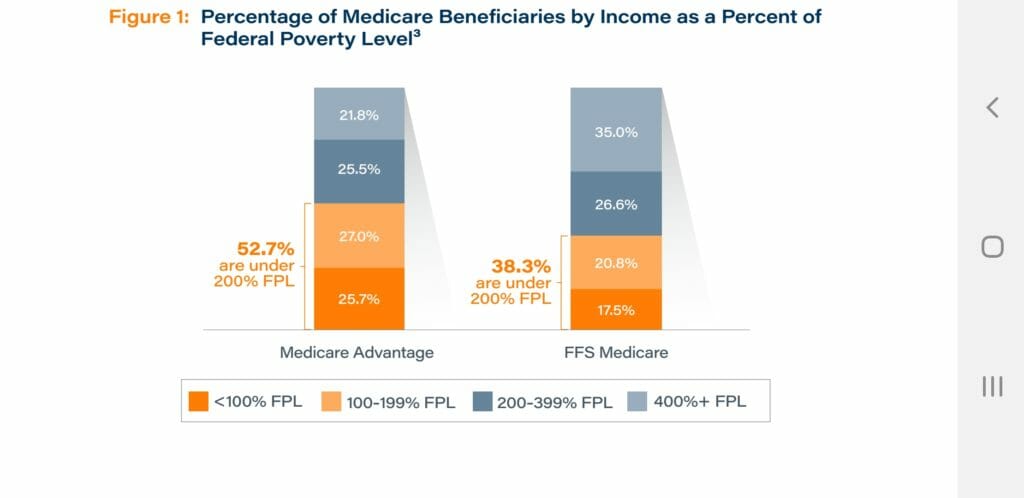

“We see particularly strong results for historically disadvantaged populations, including Black and Hispanic beneficiaries and those who are low-income,” Laura Benzing, ATI Advisory analytic lead, said in a statement.

The study found that nearly 53% of Medicare Advantage beneficiaries lived below 200% of the Federal Poverty Level. A little more than 38% of FFS beneficiaries lived below 200% of the FPL. However, the study found that 20% of FFS beneficiaries were a cost burden to the Medicare system compared to 13% of MA beneficiaries.

Growing in popularity

ATI Advisory estimates that about 45% of people 65 and older are enrolled in Medicare Advantage plans. The plans offered by private health insurance companies could outnumber traditional FFS plans by the end of the decade. MA plans have become popular with many seniors because they offer more flexibility in the benefits they offer. More than a third of plans offer supplemental benefits that include home care, meals, transportation and a variety of other services.

However, the plans do have their critics. A Harvard professor and senior adviser to the Center for Medicare and Medicaid Innovation said MA plans are growing too fast. Given how many people are signing on to MA, the plans are throwing off the payment benchmarks, which are set by Medicare FFS, he said. Also, home care companies have been outspoken in MA plans’ low reimbursement rates.