Staffing will be the focus in home care and hospice deals this year, according to Mertz Taggart Managing Partner Cory Mertz.

The mergers and acquisitions adviser told McKnight’s Home Care Daily Pulse in a recent Newsmakers podcast that buyers want to make sure there won’t be a business disruption following an acquisition, especially at a time of economic uncertainty. Mertz said that could make high staff turnover a definite deal-breaker for some acquisitive firms.

We see it in every deal,” Mertz said. “They want to ensure stability from a workforce perspective.”

Staffing remains a huge concern in the home care and hospice space. Four out of 5 providers who responded to a recent survey by home health technology firm Axxess and professional services firm SimiTree said they were adopting strategies in 2023 to improve worker retention and engagement.

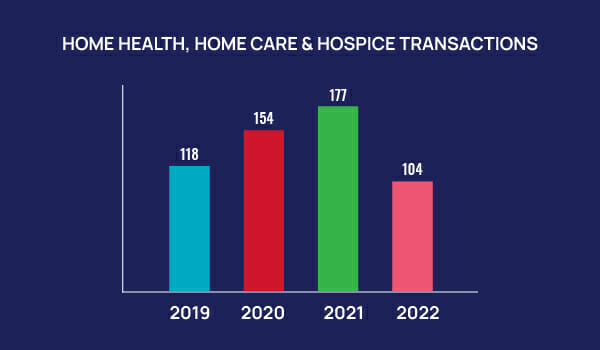

Despite their best efforts, agencies hoping to sell their businesses to private equity firms or larger providers could still see fewer takes in 2023. M&A activity in the home care, home health and hospice space cooled in 2022, following two years of robust deals. Last year the industry tallied up 104 transactions compared to 177 in 2021. However, Mertz is quick to point out the industry is returning to the more normal pace of 2019 when the industry recorded 118 deals.

Demand for home care, home health and hospice firms is still strong due to the huge number of aging baby boomers. However, Mertz said buyers will be more careful about deals. Continued uncertainty over the Medicare rate cuts to home health could be a challenge to sellers in that space.

“They are investors first and foremost,” Mertz explained. “They are always going to look forward on earnings and reimbursement in 2024 could certainly have a big impact.”

Asset valuations remain a wildcard. A recent report by business consulting firm KPMG predicted M&A activity for home care, home health and hospice would remain relatively strong this year, but valuations for those assets would decline. Mertz said he has not seen that happen yet but conceded it’s a possibility if interest rates continue to climb.